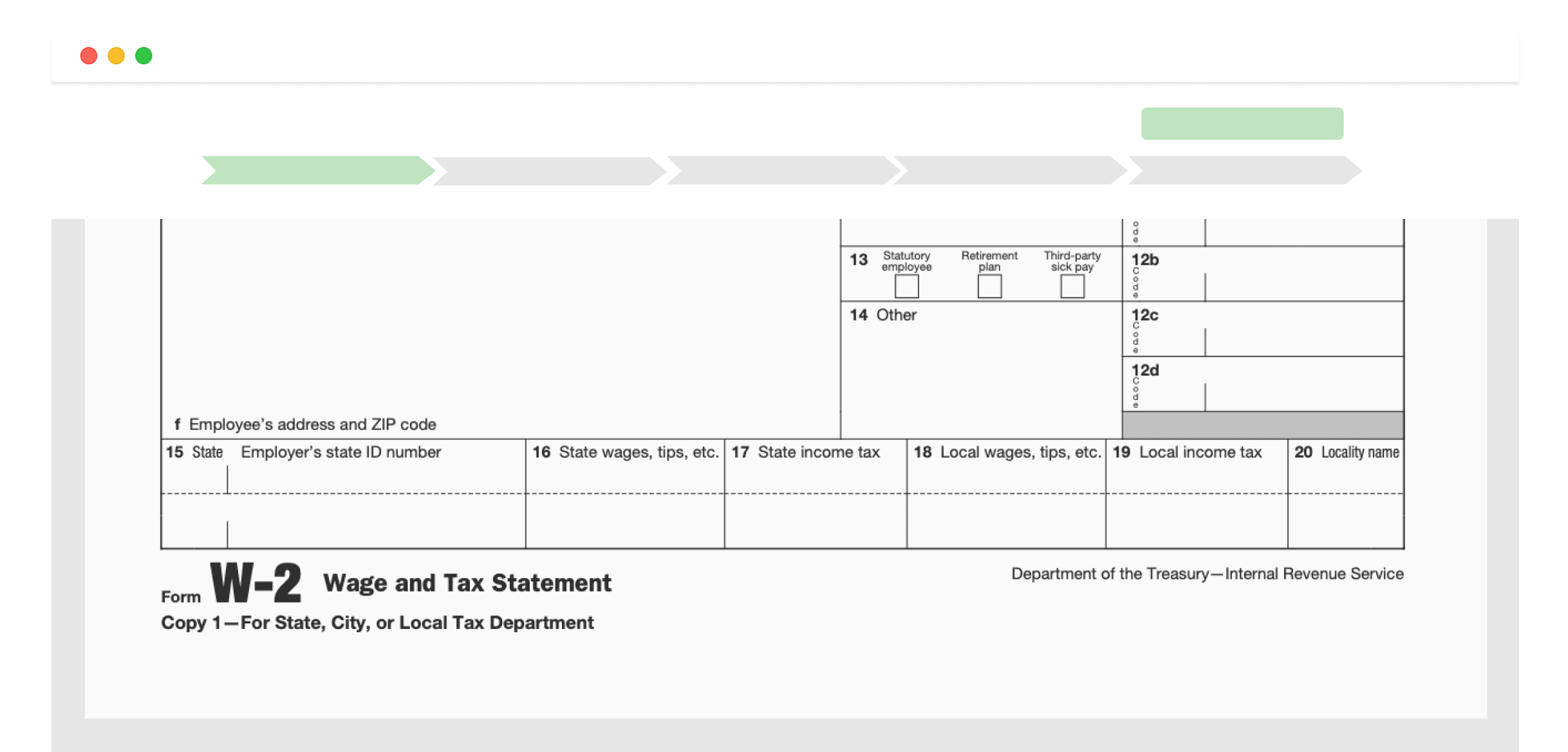

Employers provide W-2 forms to their employees on or before January 31st of each year. The W-2 form provides information about how much the employee earned during the preceding calendar year, and details amounts of tax withheld. A W-2 can be used to keep track of federal, state, and local taxes, as well as Social Security taxes and more. Employees will use W-2 forms to file their taxes with the IRS. The W-2 form is for regular employees; for independent contractors, use form 1099-NEC.